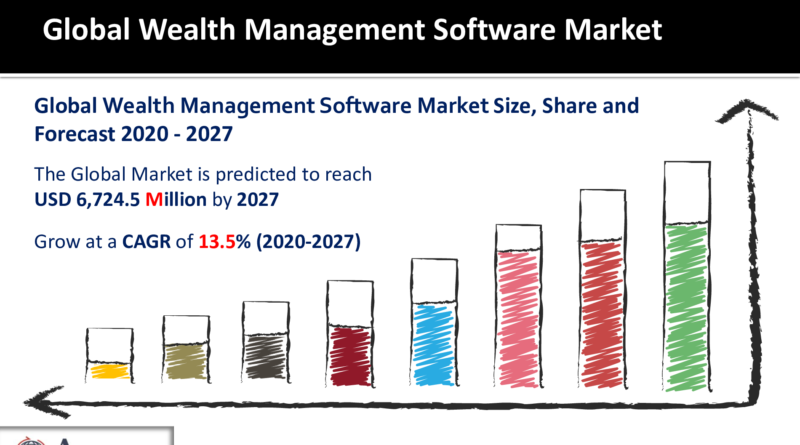

Wealth Management Software Market Size to Worth Around USD 6,724.5 Million by 2027

The report analyzes and forecasts the Wealth Management Software Market at global and regional levels. The market has been forecast based on volume (Tons) and value (US$ Mn) from 2022 to 2030. The study includes drivers and restraints of the global market. It covers the impact of these drivers and restraints on the demand during the forecast period. The report also highlights opportunities in the market at the global level.

The report comprises a detailed value chain analysis, which provides a comprehensive view of the global Wealth Management Software Market. The Porter’s Five Forces model has also been included to help understand the competitive landscape of the market. The study encompasses market attractiveness analysis, wherein various applications have been benchmarked based on their market size, growth rate, and general attractiveness.

The study provides a decisive view of the Wealth Management Software Market by segmenting it in terms of form and application. The segment has been analyzed based on the present and future trends. Regional segmentation includes the current and projected demand in North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The report provides size (in terms of volume and value) of Wealth Management Software Market for the base year 2020 and the forecast between 2021 and 2028. Market numbers have been estimated based on form and application. Market size and forecast for each application segment have been provided for the global and regional market.

Download Sample Report Copy From Here:https://www.acumenresearchandconsulting.com/request-sample/2541

In-depth interviews and discussions were conducted with several key market participants and opinion leaders to compile the research report. Primary research represents a bulk of research efforts, supplemented by extensive secondary research. Annual reports, press releases, and relevant documents of key players operating in various application areas have been reviewed for competition analysis and market understanding. Secondary research also includes recent trends, technical writing, Internet sources, and statistical data from government websites, trade associations, and agencies. These have proved to be reliable, effective, and successful approaches for obtaining precise market data, capturing market participants’ insights, and recognizing business opportunities.

Market Players as below:

Market Players as below:

The prominent players involved in global wealth management software market involve SS&C Technologies, Inc., Fiserv, Inc., Fidelity National Information Services, Profile Software, Broadridge Financial Solutions, InvestEdge, Inc., Temenos AG, Finantix, SEI Investments Company, Comarch, ObjectWay SpA, Dorsum, and among others

The major market segments of Wealth Management Software Market are as below:

Market By Advisory Model

Human advisory

Robo advisory

Hybrid

Market By Business Function

Financial advice management

Portfolio, accounting, and trading management

Performance management

Risk and compliance management

Reporting

Others (billing and benchmarking)

Market By Size of Deployment Model

Cloud

On-premises

Market By Size of Organization

Large Enterprise

SMEs

Market By End-User

Banks

Investment management firms

Trading and exchange firms

Brokerage firms

Others (asset management firms, and custody and compliance providers)

Ask Query Here: richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

Table Of Contents:

CHAPTER 1. Industry Overview of Wealth Management Software

1.1. Definition and Scope

1.1.1. Definition of Wealth Management Software

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in Global Wealth Management Software Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. Wealth Management Software Market By Advisory Model

1.2.3. Wealth Management Software Market By Business Function

1.2.4. Wealth Management Software Market By Deployment Model

1.2.5. Wealth Management Software Market By Size of Organization

1.2.6. Wealth Management Software Market By End-User

1.2.7. Wealth Management Software Market by Regions

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Sources

2.2.2. Primary Sources

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restrain 1

3.2.2. Restrain 2

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Regulatory Compliance

3.6. Competitive Landscape, 2019

3.6.1. Player Positioning Analysis

3.6.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Wealth Management Software Market By Advisory Model

4.1. Introduction

4.2. Wealth Management Software Revenue By Advisory Model

4.2.1. Wealth Management Software Revenue (US$ Mn) and Forecast, By Advisory Model, 2016-2027

4.2.2. Human advisory

4.2.2.1. Human advisory Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

4.2.3. Robo advisory

4.2.3.1. Robo advisory Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

4.2.4. Hybrid

4.2.4.1. Hybrid Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

CHAPTER 5. Wealth Management Software Market Revenue By Business Function

5.1. Introduction

5.2. Wealth Management Software Revenue (US$ Mn) By Business Function

5.2.1. Wealth Management Software Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

5.2.2. Financial advice management

5.2.2.1. Financial advice management Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

5.2.3. Portfolio, accounting, and trading management

5.2.3.1. Portfolio, accounting, and trading management Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

5.2.4. Performance management

5.2.4.1. Performance management Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

5.2.5. Risk and compliance management

5.2.5.1. Risk and compliance management Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

5.2.6. Reporting

5.2.6.1. Reporting Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

5.2.7. Others (billing and benchmarking)

5.2.7.1. Others (billing and benchmarking) Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

CHAPTER 6. Wealth Management Software Market By Deployment Model

6.1. Introduction

6.2. Wealth Management Software Revenue (US$ Mn) By Deployment Model

6.2.1. Wealth Management Software Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

6.2.2. Cloud

6.2.2.1. Cloud Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

6.2.3. On-premises

6.2.3.1. On-premises Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

CHAPTER 7. Wealth Management Software Market By Size of Organization

7.1. Introduction

7.2. Wealth Management Software Revenue (US$) By Size of Organization

7.2.1. Wealth Management Software Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

7.3. Large Enterprise

7.3.1. Large Enterprise Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

7.4. SMEs

7.4.1. SMEs Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

CHAPTER 8. Wealth Management Software Market By End-User

8.1. Introduction

8.2. Wealth Management Software Revenue (US$) By End-User

8.2.1. Wealth Management Software Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

8.3. Banks

8.3.1. Banks Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

8.4. Investment management firms

8.4.1. Investment management firms Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

8.5. Trading and exchange firms

8.5.1. Trading and exchange firms Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

8.6. Brokerage firms

8.6.1. Brokerage firms Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

8.7. Others (asset management firms, and custody and compliance providers)

8.7.1. Others (asset management firms, and custody and compliance providers) Market Revenue (US$ Mn) and Growth Rate (%), 2016-2027

CHAPTER 9. North America Wealth Management Software Market By Country

9.1. North America Wealth Management Software Overview

9.2. U.S.

9.2.1. U.S. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

9.2.2. U.S. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

9.2.3. U.S. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

9.2.4. U.S. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

9.2.5. U.S. Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

9.3. Canada

9.3.1. Canada Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

9.3.2. Canada Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

9.3.3. Canada Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

9.3.4. Canada Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

9.3.5. Canada Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

9.4. North America PEST Analysis

CHAPTER 10. Europe Wealth Management Software Market By Country

10.1. Europe Wealth Management Software Market Overview

10.2. U.K.

10.2.1. U.K. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

10.2.2. U.K. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

10.2.3. U.K. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

10.2.4. U.K. Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

10.2.5. U.K. Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

10.3. Germany

10.3.1. Germany Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

10.3.2. Germany Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

10.3.3. Germany Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

10.3.4. Germany Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

10.3.5. Germany Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

10.4. France

10.4.1. France Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

10.4.2. France Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

10.4.3. France Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

10.4.4. France Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

10.4.5. France Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

10.5. Spain

10.5.1. Spain Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

10.5.2. Spain Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

10.5.3. Spain Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

10.5.4. Spain Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

10.5.5. Spain Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

10.6. Rest of Europe

10.6.1. Rest of Europe Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016-2027

10.6.2. Rest of Europe Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016-2027

10.6.3. Rest of Europe Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016-2027

10.6.4. Rest of Europe Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016-2027

10.6.5. Rest of Europe Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016-2027

10.7. Europe PEST Analysis

CHAPTER 11. Asia Pacific Wealth Management Software Market By Country

11.1. Asia Pacific Wealth Management Software Market Overview

11.2. China

11.2.1. China Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.2.2. China Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.2.3. China Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.2.4. China Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.2.5. China Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.3. Japan

11.3.1. Japan Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.3.2. Japan Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.3.3. Japan Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.3.4. Japan Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.3.5. Japan Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.4. India

11.4.1. India Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.4.2. India Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.4.3. India Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.4.4. India Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.4.5. India Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.5. Australia

11.5.1. Australia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.5.2. Australia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.5.3. Australia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.5.4. Australia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.5.5. Australia Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.6. South Korea

11.6.1. South Korea Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.6.2. South Korea Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.6.3. South Korea Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.6.4. South Korea Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.6.5. South Korea Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.7. Rest of Asia-Pacific

11.7.1. Rest of Asia-Pacific Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

11.7.2. Rest of Asia-Pacific Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

11.7.3. Rest of Asia-Pacific Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

11.7.4. Rest of Asia-Pacific Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

11.7.5. Rest of Asia-Pacific Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

11.8. Asia Pacific PEST Analysis

CHAPTER 12. Latin America Wealth Management Software Market By Country

12.1. Latin America Wealth Management Software Market Overview

12.2. Brazil

12.2.1. Brazil Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

12.2.2. Brazil Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

12.2.3. Brazil Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

12.2.4. Brazil Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

12.2.5. Brazil Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

12.3. Mexico

12.3.1. Mexico Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

12.3.2. Mexico Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

12.3.3. Mexico Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

12.3.4. Mexico Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

12.3.5. Mexico Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

12.4. Rest of Latin America

12.4.1. Rest of Latin America Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

12.4.2. Rest of Latin America Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

12.4.3. Rest of Latin America Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

12.4.4. Rest of Latin America Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

12.4.5. Rest of Latin America Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

12.5. Latin America PEST Analysis

CHAPTER 13. Middle East & Africa Wealth Management Software Market By Country

13.1. Middle East & Africa Wealth Management Software Market Overview

13.2. Saudi Arabia

13.2.1. Saudi Arabia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

13.2.2. Saudi Arabia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

13.2.3. Saudi Arabia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

13.2.4. Saudi Arabia Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

13.2.5. Saudi Arabia Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

13.3. UAE

13.3.1. UAE Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

13.3.2. UAE Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

13.3.3. UAE Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

13.3.4. UAE Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

13.3.5. UAE Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

13.4. Rest of Middle East & Africa

13.4.1. Rest of Middle East & Africa Wealth Management Software Market Revenue (US$ Mn) and Forecast By Advisory Model, 2016 – 2027

13.4.2. Rest of Middle East & Africa Wealth Management Software Market Revenue (US$ Mn) and Forecast By Business Function, 2016 – 2027

13.4.3. Rest of Middle East & Africa Wealth Management Software Market Revenue (US$ Mn) and Forecast By Deployment Model, 2016 – 2027

13.4.4. Rest of Middle East & Africa Wealth Management Software Market Revenue (US$ Mn) and Forecast By Size of Organization, 2016 – 2027

13.4.5. Rest of Middle East & Africa Wealth Management Software Market Revenue (US$ Mn) and Forecast By End-User, 2016 – 2027

13.5. Middle East & Africa PEST Analysis

CHAPTER 14. Player Analysis Of Wealth Management Software

14.1. Wealth Management Software Market Company Share Analysis

14.2. Competition Matrix

14.2.1. Competitive Benchmarking of key players by price, presence, market share, and R&D investment

14.2.2. New Product Launches and Product Enhancements

14.2.3. Mergers And Acquisition In Global Wealth Management Software Market

14.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 15. Company Profile

15.1. SS&C Technologies, Inc.

15.1.1. Company Snapshot

15.1.2. Business Overview

15.1.3. Financial Overview

15.1.3.1. Revenue (US$ Mn), 2019

15.1.3.2. SS&C Technologies, Inc. 2019 Wealth Management Software Business Regional Distribution

15.1.4. Product/ Service and Specification

15.1.5. Recent Developments & Business Strategy

15.1.6. Manufacturing Plant Footprint Analysis

15.2. Fiserv, Inc.

15.3. Fidelity National Information Services Profile Software

15.4. Broadridge Financial Solutions

15.5. InvestEdge, Inc.

15.6. Temenos AG

15.7. Finantix

15.8. SEI Investments Company

15.9. Comarch

15.10. ObjectWay SpA

15.11. Dorsum

15.12. Others

To Get Premium Report Full Copy in Form of Single user or Multiple user@https://www.acumenresearchandconsulting.com/buy-now/0/2541

About Us:

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.