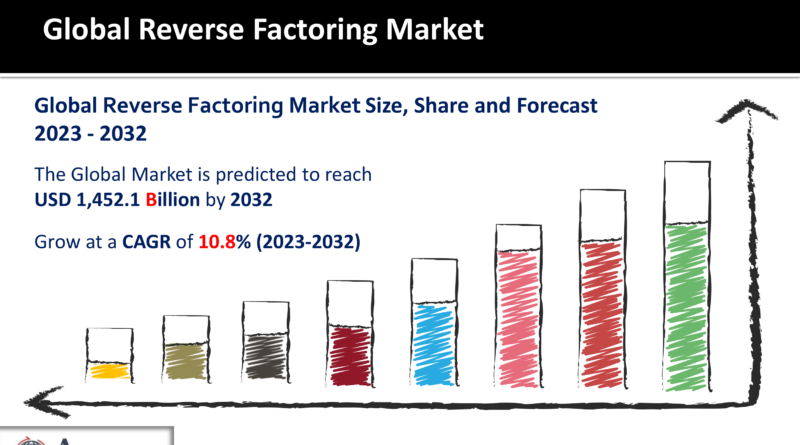

Reverse Factoring Market USD 1,452.1 Billion in 2032

The Reverse Factoring Market Size was worth USD 530.8 Billion in 2022 and is anticipated to reach USD 1,452.1 Billion by 2032, with a CAGR of 10.8% from 2023 to 2032.

Introduction

In the ever-evolving landscape of financial services, the Reverse Factoring market has emerged as a dynamic and indispensable sector. Reverse Factoring, often known as Supply Chain Financing, is experiencing significant growth and change in response to market trends and economic shifts. This article dives into the current market dynamics, drivers, restraints, opportunities, regional insights, competitive landscape, and future growth prospects of the Reverse Factoring Market.

Download Free Reverse Factoring Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart)https://www.acumenresearchandconsulting.com/request-sample/3426

Current Market Trends

Current Market Trends

The Reverse Factoring market is witnessing several notable trends that are shaping the industry’s trajectory. One prominent trend is the increasing adoption of technology. With the digital transformation of financial services, companies are leveraging advanced technologies like Artificial Intelligence and blockchain to streamline and enhance their Reverse Factoring processes. This technological integration offers quicker, more efficient solutions, reducing manual efforts and errors.

Another trend is the growing focus on sustainability and ESG (Environmental, Social, and Governance) principles. Businesses are increasingly seeking financial partners who incorporate ESG criteria into their Reverse Factoring programs, aligning with their corporate social responsibility goals. This trend is driving a shift towards green and sustainable supply chain financing solutions.

Key Market Drivers

The Reverse Factoring market’s growth is fueled by various drivers. First and foremost is the ever-increasing complexity of global supply chains. As businesses expand their operations and sources globally, supply chain financing becomes a crucial tool to manage cash flows, ensure liquidity, and support suppliers.

Moreover, the ongoing economic uncertainty stemming from events like the COVID-19 pandemic has heightened the need for financial stability. Reverse Factoring provides a reliable means of ensuring suppliers’ financial security, reducing the risk of supply chain disruption.

Regulatory support is also a significant driver, with governments worldwide recognizing the importance of supply chain financing for economic stability. Policies and regulations that encourage and support Reverse Factoring have played a vital role in its growth.

Market Restraints

Despite the promising outlook, the Reverse Factoring market faces certain restraints. One of the key challenges is the complex legal and regulatory framework governing supply chain finance in different regions. Companies operating globally must navigate a web of regulations and standards, which can be a cumbersome and time-consuming process.

Cybersecurity concerns also pose a significant restraint. As Reverse Factoring becomes increasingly reliant on digital technologies, the risk of cyberattacks and data breaches looms large. Firms in the sector must invest in robust cybersecurity measures to protect sensitive financial and supplier information.

Opportunities on the Horizon

The Reverse Factoring market offers several exciting opportunities for businesses and investors. One of the most promising opportunities is the growth of SME-focused programs. Small and medium-sized enterprises often face challenges in accessing traditional financing. Reverse Factoring tailored for SMEs is gaining traction, opening up new markets and increasing inclusivity in the financial sector.

Moreover, the growing trend towards integrated supply chain solutions presents an opportunity for Reverse Factoring providers to expand their services. By offering end-to-end supply chain solutions, companies can create a competitive advantage and increase their market share.

Regional Insights

The Reverse Factoring market is not homogenous, with regional nuances and differences in market dynamics. In North America, the market is mature and well-established, with a focus on technology-driven solutions. Europe has been a leader in sustainability-focused supply chain financing, aligning with its strong ESG commitments. In Asia, particularly in countries like China and India, the market is rapidly growing as supply chains expand, providing ample opportunities for growth.

Competitive Landscape

The competitive landscape of the Reverse Factoring market is evolving rapidly. Major financial institutions, including banks and fintech companies, are entering the space, intensifying the competition. Traditional banks are adapting to the changing landscape by investing in technology and forming strategic partnerships with fintech firms. Meanwhile, fintech companies are leveraging their agility and innovation to gain a competitive edge.

Prominent players in the market include Citigroup, HSBC, Banco Santander, and fintech companies like Greensill and Taulia. As the market grows, competition is likely to drive further innovation and customer-centric solutions.

Future Growth Prospects

The future of the Reverse Factoring market is bright. With the continued growth of global supply chains, the increasing adoption of technology, and the focus on sustainability, this market is poised for robust expansion. As companies recognize the benefits of supply chain financing for their operations, the demand for these services is likely to soar.

Furthermore, the potential integration of blockchain technology and smart contracts can offer secure, transparent, and efficient supply chain financing solutions, creating new avenues for growth.

Reverse Factoring Market Player

Some of the top reverse factoring market companies offered in the professional report include Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH.

Get Discount On The Purchase Of This Report:https://www.acumenresearchandconsulting.com/buy-now/0/3426

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +91 8983225533

or +1 347 474 3864