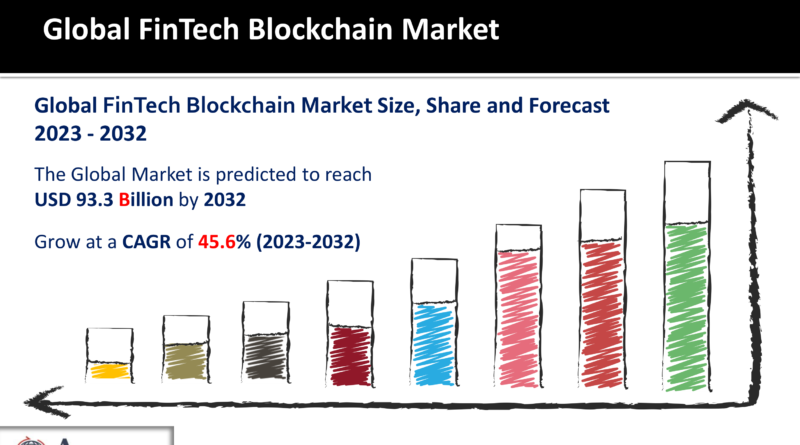

FinTech Blockchain Market To Reach USD 93.3 Billion By 2032

The FinTech Blockchain Market Size accounted for USD 2.2 Billion in 2022 and is projected to achieve a market size of USD 93.3 Billion by 2032 growing at a CAGR of 45.6% from 2023 to 2032.

Introduction

In recent years, the FinTech Blockchain market has been at the forefront of transformative trends, reshaping the financial landscape and offering innovative solutions that have the potential to disrupt traditional financial institutions. As the global financial sector becomes increasingly digital, the convergence of financial technology (FinTech) and blockchain technology is gaining momentum, fueling rapid growth and fostering a dynamic market landscape. In this article, we’ll explore the current market trends, dynamics, segmentation, regional analysis, key players, and competitive landscape of the FinTech Blockchain market.

Download Free FinTech Blockchain Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart)https://www.acumenresearchandconsulting.com/request-sample/3447

Current Market Trends

Current Market Trends

Decentralized Finance (DeFi) Dominance: DeFi platforms have garnered substantial attention, offering decentralized lending, trading, and yield farming opportunities. As a result, DeFi projects are increasingly leveraging blockchain technology to provide secure and transparent financial services.

Tokenization of Assets: The tokenization of real-world assets, such as real estate, art, and stocks, is a growing trend within the FinTech Blockchain market. This approach enhances liquidity, accessibility, and reduces friction in asset trading.

CBDC Development: Central banks worldwide are exploring the concept of Central Bank Digital Currencies (CBDCs). Blockchain technology is integral in the development of CBDCs, potentially replacing or supplementing traditional cash.

Enhanced Security Measures: Blockchain’s immutability and cryptographic features make it an ideal technology for ensuring the security and transparency of financial transactions. Cybersecurity concerns have propelled the adoption of blockchain technology in FinTech.

Market Dynamics

The FinTech Blockchain market is characterized by the following dynamics:

High Growth: The market is experiencing rapid growth due to the increased adoption of digital financial services and the integration of blockchain technology to enhance security and efficiency.

Regulatory Challenges: Regulatory frameworks for blockchain technology in finance are still evolving, and compliance remains a concern for market participants.

Competition: The market is highly competitive, with both established financial institutions and startups vying for market share. The adaptability and scalability of blockchain solutions play a significant role in determining success.

Investment Surge: A significant increase in investment and funding for FinTech Blockchain startups has been observed, reflecting strong investor confidence in the sector.

Segmentation in Pointers

The FinTech Blockchain market can be segmented as follows:

By Type:

Public Blockchain: Open to all, offering decentralization and transparency.

Private Blockchain: Restricted access for authorized participants, ideal for businesses.

By Application:

Payments and Remittances: Blockchain technology is used to enhance cross-border payments and streamline remittance processes.

Smart Contracts: Self-executing contracts that automate and validate transactions.

Digital Identity: Blockchain technology is leveraged to secure digital identities and reduce identity theft.

Asset Management: Tokenization of assets for efficient trading.

By End-User:

Banks and Financial Institutions

Payment Service Providers

Startups and SMEs

Regional Analysis

The FinTech Blockchain market exhibits regional variations in adoption and growth:

North America: The region has a well-established FinTech and blockchain ecosystem, with the United States leading the way in innovation and investment.

Europe: European countries, such as Switzerland, are embracing blockchain technology for banking and financial services, with regulatory clarity contributing to growth.

Asia-Pacific: Countries like Singapore and Japan are at the forefront of blockchain adoption, with government support and active innovation hubs.

Middle East and Africa: These regions are exploring blockchain technology for financial inclusion and cost-effective cross-border transactions.

Latin America: Adoption in Latin America is gaining momentum, with blockchain-based solutions addressing financial inclusion and remittances.

Key Market Players

Several key players are shaping the FinTech Blockchain market:

Ripple : Known for its blockchain-based payment solutions, Ripple has partnered with numerous financial institutions to facilitate cross-border payments.

Ethereum : Ethereum is a pioneer in smart contract technology, enabling a wide range of applications within the FinTech sector.

IBM Blockchain and Supply Chain : IBM offers blockchain solutions for supply chain management, trade finance, and digital identity verification.

Consensys : Focused on Ethereum-based solutions, Consensys provides tools and platforms for developers and enterprises.

Chainlink : Specializing in decentralized oracles, Chainlink connects smart contracts to real-world data sources.

Competitive Landscape

The competitive landscape in the FinTech Blockchain market is intensifying. Traditional financial institutions are partnering with blockchain companies to modernize their systems and remain competitive. Startups are driving innovation, while regulatory developments continue to play a crucial role in shaping the industry.

Get Discount On The Purchase Of This Report:https://www.acumenresearchandconsulting.com/buy-now/0/3447

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864