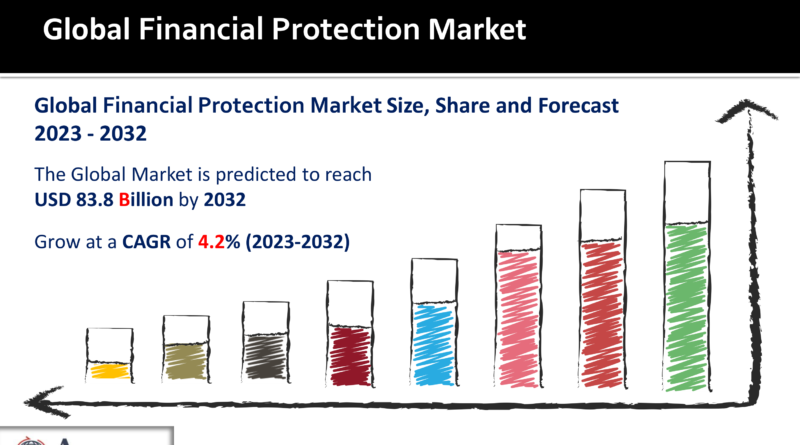

Financial Protection Market Size, Share, Growth Forecast 2023-2032

Introduction

In today’s fast-paced and uncertain world, financial protection has become a top priority for individuals and businesses alike. The Financial Protection Market, encompassing a wide range of insurance and investment products, plays a pivotal role in securing financial well-being. This article delves into the current market trends, drivers, restraints, opportunities, regional market insights, competition scenario, and future growth potential within the Financial Protection Market.

Download Free Financial Protection Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart)https://www.acumenresearchandconsulting.com/request-sample/3219

Current Market Trends

Current Market Trends

Digitization and Insurtech: The Financial Protection Market is witnessing a digital transformation. Insurtech companies are leveraging technology to streamline operations, enhance customer experiences, and develop innovative insurance products. This trend is not only increasing efficiency but also broadening market reach.

Personalized Solutions: Consumers are demanding more personalized financial protection solutions. Insurers are using data analytics to tailor policies to individual needs, resulting in higher customer satisfaction and retention rates.

Sustainable Investing: Environmental, Social, and Governance (ESG) factors are gaining prominence in the Financial Protection Market. Investors are increasingly seeking insurance and investment products that align with their ethical and sustainable values.

Market Drivers

Growing Awareness: The global pandemic has heightened awareness of the importance of financial protection. Individuals and businesses are now more conscious of the need for insurance coverage and risk mitigation.

Regulatory Support: Governments and regulatory bodies are introducing policies to promote the adoption of insurance and financial protection products. This includes tax incentives and mandatory insurance requirements in various sectors.

Aging Population: The aging population in many regions is driving the demand for retirement and long-term care insurance products. As people live longer, they seek financial security during their retirement years.

Market Restraints

Economic Uncertainty: Economic fluctuations and uncertainties can impact the willingness of individuals and businesses to invest in financial protection products. High unemployment rates and economic downturns may lead to reduced insurance purchases.

Pricing Challenges: In a competitive market, pricing is a critical factor. Insurers face challenges in balancing affordability for consumers while maintaining profitability.

Opportunities

Emerging Markets: Emerging economies present significant growth opportunities for the Financial Protection Market. As disposable incomes rise and awareness increases, more people in these regions are seeking insurance and investment products.

Health and Wellness Products: The COVID-19 pandemic has emphasized the importance of health and wellness. There is a growing opportunity for insurers to offer products that cover health-related expenses and promote well-being.

Regional Market Insights

North America: The North American market is well-established and highly competitive. It’s characterized by a wide range of insurance and investment products, with a strong emphasis on digitization and ESG investing.

Europe: European markets are increasingly focusing on sustainable and ESG-driven financial protection products. Regulatory changes, such as Solvency II, are influencing the market landscape.

Asia-Pacific: The Asia-Pacific region is witnessing rapid growth, driven by a rising middle class and increased awareness. Insurtech innovations and government support are fostering market expansion.

Competition Scenario

The Financial Protection Market is fiercely competitive. Established insurance companies, insurtech startups, and financial institutions are all vying for market share. Competition is driving innovation, leading to the development of more customer-centric products and services.

Future Market Growth Potential

The future of the Financial Protection Market looks promising:

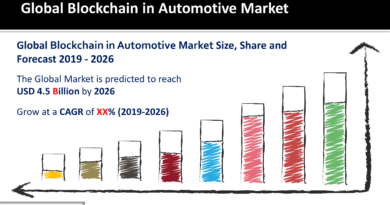

Technology Integration: Further integration of technology, including blockchain and artificial intelligence, will enhance underwriting, claims processing, and risk assessment.

Cybersecurity Insurance: With the increasing threat of cyberattacks, cybersecurity insurance will become a major growth area within the market.

Sustainable Finance: Sustainable finance will continue to gain momentum, with insurance and investment products aligning with ESG principles.

The Financial Protection Market is evolving to meet the changing needs of individuals and businesses. Current trends such as digitization, personalized solutions, and sustainability are reshaping the industry. As awareness grows and regulatory support increases, the market is set to expand further, especially in emerging economies. While challenges exist, the future holds immense potential for innovative solutions and sustainable financial protection. Investors, insurers, and consumers alike should keep a close eye on this dynamic market.

Financial Protection Market Players

Some of the top financial protection companies offered in our report include Allianz SE. Prudential Financial Inc., AIG (American International Group), MetLife Inc., AXA SA, Zurich Insurance Group Ltd., Manulife Financial Corporation, New York Life Insurance Company, Ping An Insurance Group, and Berkshire Hathaway Inc.

Get Discount On The Purchase Of This Report:https://www.acumenresearchandconsulting.com/buy-now/0/3219

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864