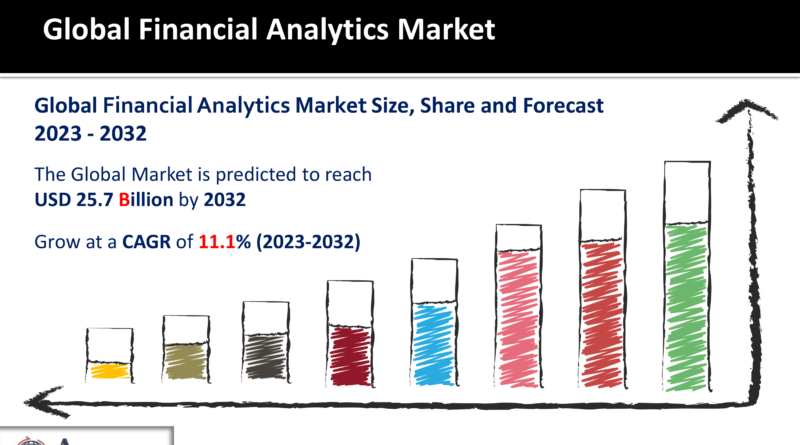

Financial Analytics Market Growth Analysis and Forecasts 2023 – 2032

The Financial Analytics Market Size was valued at USD 9.1 Billion in 2022 and is projected to reach USD 25.7 Billion by 2032, registering a CAGR of 11.1% during the period from 2023 to 2032.

Introduction

The financial world is undergoing a seismic shift, driven by technology and data. Financial institutions, businesses, and investors are navigating a complex landscape, and the key to success lies in making data-driven decisions. This article explores the current market trends, drivers, restraints, opportunities, regional insights, competitive landscape, future growth prospects, and the largest market players in the Financial Analytics sector.

Download Free Financial Analytics Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart)https://www.acumenresearchandconsulting.com/request-sample/2482

Market Trends

Market Trends

Financial Analytics, also known as FinTech, is experiencing several transformative trends:

Advanced Data Analytics: The utilization of machine learning and artificial intelligence to sift through massive datasets for insights has become a hallmark of financial analytics. It enables institutions to better predict market movements and make informed investment decisions.

Real-time Analysis: The demand for real-time financial analytics is growing. This trend is particularly prevalent in trading, where every second counts. Real-time analytics provide traders with an edge in an increasingly competitive market.

ESG Integration: Environmental, Social, and Governance (ESG) considerations are gaining prominence. Financial analytics tools now incorporate ESG data to help investors make ethical and sustainable investment decisions.

Regulatory Compliance: Increasingly stringent regulatory requirements are driving the adoption of financial analytics tools to ensure compliance. These tools assist financial institutions in monitoring and reporting financial activities accurately.

Personalized Insights: The rise of robo-advisors and personalized investment strategies is being powered by financial analytics. Investors now receive tailored recommendations based on their financial goals, risk tolerance, and personal preferences.

Market Drivers

Several drivers are fueling the growth of the financial analytics market:

Data Abundance: The digital era has generated an unprecedented volume of financial data, and the need to harness this information for making strategic decisions has never been greater.

Cost Efficiency: Financial analytics tools offer cost-effective solutions by automating tasks and reducing the need for human intervention, thereby enhancing operational efficiency.

Globalization: In an increasingly interconnected world, financial analytics helps investors and businesses analyze data from global markets and make informed decisions on a global scale.

Risk Management: The ability to predict and manage financial risks is crucial, especially in volatile markets. Financial analytics provides the tools necessary for proactive risk management.

Market Restraints

While the financial analytics market holds immense promise, it also faces certain restraints:

Data Security Concerns: With the proliferation of data comes the heightened risk of data breaches and cyberattacks. Financial institutions must invest heavily in cybersecurity to protect sensitive financial data.

Complexity: Financial analytics tools can be complex and may require specialized training for effective use, which can be a barrier for small businesses or individuals.

Opportunities

In the financial analytics market, opportunities abound:

Emerging Markets: As economies in emerging markets grow, so does the demand for financial analytics tools. These regions offer a significant growth opportunity for established and emerging market players.

Innovation: The financial analytics sector continues to evolve, and innovation in AI, machine learning, and blockchain technologies offers new avenues for growth.

Regional Insights

The adoption of financial analytics varies across regions:

North America: North America dominates the financial analytics market, with the United States at the forefront. The region’s financial institutions are early adopters of advanced analytics.

Europe: Europe, led by the United Kingdom and Germany, is a strong contender in the financial analytics market. Brexit and regulatory changes continue to drive demand for these tools.

Asia-Pacific: The Asia-Pacific region, especially China and India, presents immense growth potential. The rapid expansion of financial markets in these countries is fueling the adoption of financial analytics.

Competitive Landscape

The financial analytics market is highly competitive, with key players including IBM, Oracle, SAP, SAS Institute, and Tableau Software. These companies offer a wide range of financial analytics solutions, each with its unique features and capabilities.

Future Growth Prospects

The future of the financial analytics market is bright:

AI and Machine Learning: The integration of artificial intelligence and machine learning will continue to enhance predictive capabilities, providing investors with a competitive edge.

Cloud-Based Solutions: Cloud-based financial analytics solutions will gain prominence due to their scalability, flexibility, and cost-effectiveness.

Blockchain: The adoption of blockchain technology in financial analytics promises to increase transparency and security, particularly in transaction tracking and record-keeping.

Customization: Financial analytics tools will become increasingly customizable, catering to the specific needs of businesses and investors.

Buy the premium market research report here:https://www.acumenresearchandconsulting.com/buy-now/0/2482

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864